You can easily secure loans in Kenya without security although you face one drawback… loans without security often carry a higher interest rate.

In addition, you may not always access bigger amounts as most lenders giving soft loans without collateral restrain from advancing higher loans due to the involved risk.

Other than that, the requirements are minimal and in most cases, you receive the cash instantly.

The purpose of this article is to show you where you can access loans in Kenya without security, how to qualify, and the applicable terms..

Overall, you can get loans without security from any of the following categories of lenders:

- Quick online MPESA loans apps

- Financiers offering International loans in Kenya

- Selected banks offering unsecured loans in Kenya

- Online and offline emergency loans Kenya lenders

Where to get Loans in Kenya without security

I will now expound on each of the above-listed alternatives starting with everyone’s favorite- mobile loan apps.

· Quick online MPESA loans apps

For most Kenyans, the first stop when in a fix is the myriad apps offering loans in Kenya. You only need to download your favorite app then complete the short application process.

Your cash is sent to your mpesa instantly.

I recommend these apps if you’re after a convenient personal loan for students with no job in Kenya, perhaps to start a small side hustle.

Some Kenyans call loan apps sportpesa loans since they often access betting cash for sportspesa, Betika, and other gaming platforms from them.

Here is a brief overview of the most popular quick online instant mpesa loans mobile applications.

1. Tala quick mobile loans in Kenya

You can request a loan of up to shs 30000 from Tala loan app for both personal or business use.

The loan app allows you a maximum of 30 days for the first loan at a one-time loan service fee of between 5%-15% of the loan principal.

Download the app here to start your application.

The rates is offer

· Also Read: Tala loan application form: How to get an MPESA loan in 3 minutes

2. Mshwari loans without security in Kenya

You can quickly obtain a micro unsecured loan of at least KSHs.100 any time from Safaricom at an affordable facility fee of just 7.5%.

How to apply for an mshwari loan:

- Open the M-PESA menu on your phone.

- Choose Loans and Savings.

- Click M-Shwari.

- Select Loan.

- Next, select request Loan.

- Enter the desired amount.

- Enter your regular M-PESA PIN

- The Loan will be sent straight to your M-PESA .

Be sure to deposit at least shs.50 to your mshwari before applying. Here are the steps:

- Open the M-PESA menu on your phone.

- Choose Loans and Savings.

- Click M-Shwari.

- Select send to mshwari.

- Next, type the amount e.g. 50.

- Enter your regular M-PESA PIN

3. Branch loan app

With branch, you can receive up to shs.70000 in the form of a loan without security within moments.

You can pay over 4-48 weeks while Branch’s Interest is between 13% – 29%.

Download the branch loan app here to apply.

4. Haraka loan app.

Haraka loan is another super quick way to acquire a loan without security in Kenya from anywhere via your mobile phone.

They give unsecured first loans up to a maximum of kshs. 5,000. Their loan interest averages about 30% for first loans.

Follow the steps in our Haraka loan application article to complete your loan application.

5. Zenka loan app

With Zenka, your first loan is completely free!

Yes, you’ve heard me right..

Zero registration fee, 0% interest, and 0% commission!.

You can even extend your repayment deadline by 7, 14, or even 30 days.

Download Zenka app. here then complete the Zenka loan application form to access loans.

6. KCB Mpesa loans in Kenya without security

KCB bank awards mpesa loans payable within one month at a one-off charge of 7.5% of the loan including the excise duty chargeable on the loan fees.

Here are the steps:

- Go to M-PESA .

- Choose Loans & Savings

- Click KCB M-PESA

- Select loan then click Request Loan.

- Type the loan Amount you wish to request.

- Enter your KCB M-PESA PIN

- The app will send the loaned amount to your phone’s mpesa or else inform you about how much loan you qualify for.

With time, the app can advance you a ksh 10000 loan and even more, especially if you always repay on time.

Also Read: Mshwari Lock Savings Account: All you need to know

· Selected banks offering unsecured loans in Kenya

If you have a great relationship with your bank, check if they offer unsecured loans.

Your bank is actually likely to offer larger loan amounts and better rates as long as you have a good credit history.

For this reason, the bank might be the perfect option if you’re looking for loans in Kenya without security to start a business.

Some of the renowned bank-based unsecured loans in Kenya include:

1. Equity bank unsecured loans

As you might be aware, Equity Bank also has a number of unsecured loans for small traders and individuals.

The loan amount depends on your account history and you can even check how much you qualify for from the Equitel app.

You can confirm everything from Equity Bank’s website.

2. KCB unsecured loan

In addition to the KCB mpesa, you may want to look at the myriad kcb business loans as well as personal credit facilities.

You will need to fill the prescribed KCB bank loan application form and supply the required documentation before loan approval.

Check the details here.

3. National bank online loans

National Bank has several unsecured personal loans to help you achieve your dreams.

The target is mostly salaried Kenyans working with reputable organizations on permanent employment terms.

The least loan you can apply for shs.50000.

4. NIC Bank loans in Kenya without security

NIC mobile lending arm has an instant loans facility that can lend you as much as Ksh. 50,000 through your phone.

Click here to open the application website.

Also Read: Looking for the best savings account in Kenya? Check these accounts

· Financiers offering International loans in Kenya

If you’re planning to borrow a significant amount of money, consider finance offers from international financiers giving out loans in Kenya without security.

Go through the following list to see if anyone of them could be ideal for your needs.

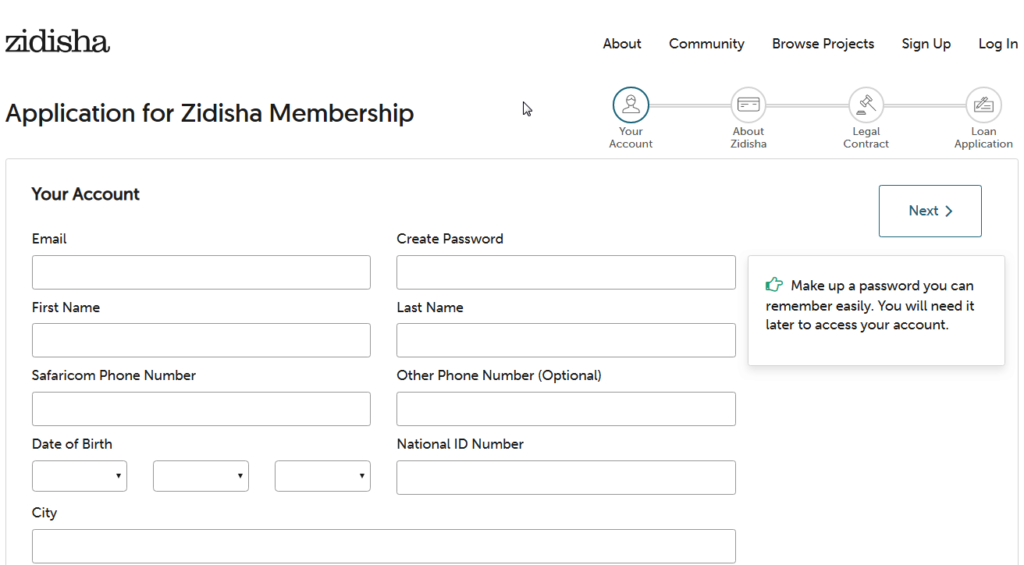

1. Zidisha Loans by Zidisha.org

If you’re searching for business online loans, you can apply for a microloan from the Zidisha, one of the lenders advancing international loans in Kenya.

Zidisha loans start small but you can be awarded sizeable amounts with time.

The platform brings together lenders and borrowers online and has loaned over shs.1.6 billion so far.

Minimum qualifications:

You must be running a small business to qualify for Zidisha loans.

How it works:

- You start the seamless application process here . Make sure you’re logged into your FaceBook account before you register.

- Fill in the provided loan application form from within the Zidisha portal.

- Wait for feedback and further directions.

2. IFC (International finance corporations) loans

IFC, World bank’s global private and business lending arm can be a great option for business loans without security.

The application and approval process takes slightly longer than instant mobile loans but on the other hand, IFC loans are pretty cheap, making them quite attractive.

Additionally, you can secure millions of shillings for your business provided your idea is technically sound.

Minimum qualifications:

You need to have a business or planning to start one. Besides, you must not be bankrupt.

How it works:

- You apply for the loan by submitting an investment proposal.

- Wait for feedback and further directions.

· Online and offline emergency loans Kenya lenders

You can also look at a couple of informal lenders scattered across the country and online.

These include:

1. Zawadi Loans

Zawadi Kenya limited offers loans without security in Kenya the same day.

To save your precious time, Zawadi Kenya hassle-free loans applications are done online and you get feedback within 2 hours.

Minimum qualifications:

You need to be salaried to qualify for Zawadi loans.

How it works:

- You Apply online here

- The lender reviews your application and replies within two hours.

- If you qualify, you’re asked to submit necessary documents such as your ID and copy of payslip.

- You receive your cheque.

2. izwe loans Kenya

izwe loans Kenya provides purpose-based Personal Loans but mainly only for civil servants and TSC members.

These unsecured loans are deducted from your next salary and are disbursed within 24 hours.

iZwe’s Annual Percentage Rate (APR) averages 50% -112%.

Minimum qualifications:

Like I have mentioned, you must be a civil servant or be working for a parastatal.

How it works:

- You can make your application online here . You also have the choice of applying physically to any of their branches in Nairobi, Mombasa, or izwe loans Kisumu. Call them on 0709 530 000 or send an SMS with the word izwe to 20499.

- You will receive a loan offer within minutes

- Accept the offer.

- Izwe releases your cash.

iZwe loans Kenya Nairobi is located on 46 Kabarsiran Avenue, Muthangari, Nairobi

3. Tadissa Capital

You can get an unsecured loan within 24 hours to bridge you to your next salary from Tadissa capital, one of the upcoming credit companies in Kenya.

Minimum qualifications:

Like iZwe, Tadissa lends emergency loans to salaried people.

How it works:

Apply directly on the website or visit Tadissa offices located at Shelter Afrique House,

Mamlaka Road, Nairobi.

Loans in kenya without security : Frequently asked questions (FAQs)

How can I get a loan without security / How do I get an unsecured loan?

If you’re borrowing from offline lenders that don’t ask for securities like Tadissa capital or Sasa credit, visit the lender.

Online loans in Kenya are ,however, more convenient since you either download the app or apply from their websites directly.

Where can I borrow money fast in Kenya?

You can borrow money fast in Kenya from the myriad online loan apps. You can as well contact non-deposit taking lenders such as Platinum credit or izwe loans Kenya.

How can I get a quick loan?

Like I have mentioned above, just download your mobile loan of choice, for example, Tala loan app or Branch app then complete the loan application form.

The cash is disbursed to your mpesa within minutes.

Also Read: Here Is What You Need To Know About Fuliza From Safaricom

In summary

You have several alternatives when looking for loans in Kenya without security chief among them the mobile loan apps.

Your other possibilities include private lenders such as izwe loans and banks such as KCB unsecured loans.

For unsecured business loans, the best alternatives include Zidisha (micro loans) and IFC loans (bigger amounts).

Having said that, I shall be updating this article as soon as I come across other viable loans in Kenya without security offers.

In the meantime, compare and evaluate the above-mentioned above.

Willing to work on line