Unlike traditional lenders like banks and SACCOs, all you need to access an instant loan to your MPESA from Tala is to complete the Tala loan application form.

As you will see shortly, it’s a simple form and since you do it from your phone, you will have your loan approved within minutes.

This article will show you how to download Tala (previously known as Mkopo Rahisi) and fill the Tala loan application form.

Your loan is usually credited to your Mpesa shortly thereafter.

Let’s go straight to the steps:

Tala loan application form: Step-by-step Instant Loan application Guide

1: Tala apk download

You can only open the Tala loan application form from the Tala loan app so start by downloading it.

Step-by-step:

- Go to Google Playstore on your Smartphone and type Tala loan app to search for the app.

- It should appear on your screen after a short while. Select Install.

- Hold on for some moments as your phone downloads and install the app.

Side note:

Please don’t search for Tala loan app for iPhone!

It’s not available because iPhone have robust security controls and will deny the App access to some of the information it requires to evaluate your loan application.

Windows phone users can, however, download the Tala app by visiting the Microsoft app store.

· ALSO READ: Where to get Unsecured Personal loans in Kenya (And the terms)

2: Tala registration

Just before we discuss how to complete the Tala loan application form in Kenya from your phone, let’s learn how to register.

The purpose of the Tala registration is to capture some of your basic information to facilitate your loan application.

Tala will also confirm your identity during this step.

Side note:

Tala works only via MPESA currently so ensure that you’re using your Safaricom line during the application.

Also, check that you’re logged in to your Facebook account before proceeding since the app will be connecting to your Facebook account during the registration.

Step-by-step:

I want to assume that you haven’t closed the newly installed Tala app (If you have, locate it from your installed apps area) and then..

- Click Open on the app.

- Click Sign-up (new borrowers).

- Type your Safaricom number then press Verify. The system sends to your phone a verification code in form of SMS- it should automatically insert itself in the provided space. Click next as soon as it does this.

- Now type all the asked-for details in the respective spaces….Your name, ID no., income/work, Education level, etc. Answer everything and select next.

It’s important that you be truthful when answering the questions here as the answers influences Tala’s decision on whether it shall give you a loan and the loan amount. And don’t forget to create a good 4-digit PIN.

- Be sure to countercheck everything once asked to.

With that out of our way, we can now tackle the most exciting step- how to make your Tala application for a quick loan.

How do i apply for a Tala loan?

You fill in the Tala loan application form.

Follow these steps…

Step-by-step

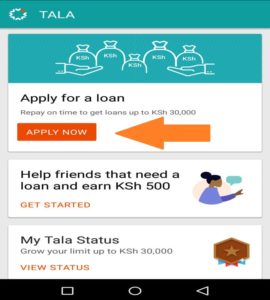

- Open your Tala app and Click the button Apply loan. Type your PIN if prompted to.

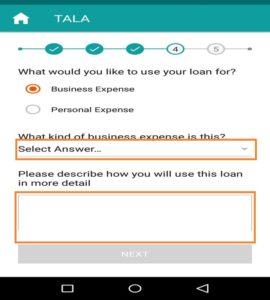

- The Tala loan application form loads on your phone’s screen. Again Enter the necessary information honestly including how you’ll be using the loaned amount.

- Click Next after each step until you’re through.

- Review your answers and Edit if you want to amend any section. Otherwise, click Continue

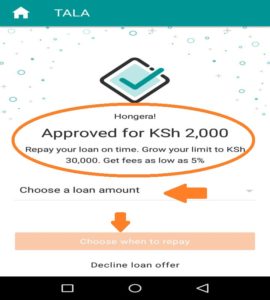

- Soon a screen loads informing you of how much Tala has approved as your loan. You can click on Choose a loan amount to borrow a lesser amount.

- Click Choose when to repay to specify your most convenient Tala loan repayment period (30/21 days). The service fee will also be indicated appropriately.

- Click to select whichever option you prefer then click Accept.

Congratulations! Your money will shortly be deposited into your MPESA account.

If you wish to withdraw the amount, just walk into your nearest MPESA agent and make an immediate withdrawal..

Can you see how simplistic the entire Tala emergency loan application process is?

Let’s now look at how you will be repaying your Tala loan when the time comes…

· ALSO READ: Zidisha Loan App: Downloading and loan application guide

Tala loan repayment

Just like the loan application process, Tala has also simplified the loan repayment process. You actually can choose to pay directly from the app or via Tala paybill number.

Here is how to do it..

How to pay Tala Loan using MPESA

- Open the MPESA menu on your phone.

- Select Lipa na MPESA.

- Click

- Enter Tala Paybill number

- Enter your Tala-registered Safaricom phone number.

- Type the amount you’re repaying then your MPESA pin, and press OK.

- Confirm the details and wait for the payment transaction to go through if happy.

You are immediately sent an SMS by Tala and MPESA confirming the payment.

How to pay Tala Loan from the Tala app

You can as well pay from inside the app.

Step-by-step:

- Open the app.

- Enter your PIN if asked.

- Your current loan is shown there on the screen and you will see a message asking you to pay. Click on the message.

- This automatically loads the MPESA Menu. Simply type (or copy-paste) the amount you wish to pay, type your PIN, and proceed to make the payment.

Tala Paybill

Tala paybill number is 851900 as I had mentioned above.

Since we are done with most of the basics, let’s now discuss a couple of other issues surrounding the Tala app and its usage.

Update Tala App

You should try to update the Tala app as often as possible. That’s because a properly update app is more secure (You know we are living in the age of hackers) besides being a joy to use.

Additionally, Tala is always upgrading the app and adding new features so you will get an opportunity to enjoy the latest thrilling features in the app.

Here is how to update Tala app.

Step-by-step:

- Open Google Playstore.

- Locate the Tala app from the list of installed apps.

- Click You will notice the Update button displayed if the app has pending updates. Simply click Update. If not, the app is updated and you don’t need to take any action.

Side notes:

- You should be connected to a reliable Wi-Fi or have adequate bundles before commencing the process.

- Like most of the apps offering online loans in Kenya, Tala app updates automatically the moment you connect to a Wi-Fi so you’re hardly required to perform manual updates.

Requirements to qualify for Tala loan (How do I qualify for a Tala loan?)

To be awarded a loan, Tala requires that:

- You’re an adult (at least 18 years old).

- You have an active Facebook account.

- You own an active email address.

- You have a registered Safaricom mobile number.

- You are using a smartphone.

Note that you can only connect one Tala account to your mobile phone so you’re likely to receive an error if your phone was previously linked to a different account.

In such a case, just contact the Tala customer care staff using the contact details below for assistance.

· ALSO READ: Haraka loan application: Instant MPESA Loans [Step-by-step]

Tala contacts

You can ask for help from the super-helpful Tala customer care agents if stuck when downloading or when filling the Tala loan application form.

Use these Tala loan contacts..

Official website: https://tala.co.ke

Email address: hellokenya@talamobile.com

SMS contact: 21991

Tala kenya contacts –Social media

Tala Facebook: https://web.facebook.com/talakenya

Twitter: https://twitter.com/talamobile?lang=en

Instagram: https://www.instagram.com/talamobile

Linkedin: https://www.linkedin.com/company/tala-mobile/

Tala Loan Terms and Conditions

Tala charges a 5-15% one-time service fee on your loan principal and you are allowed to pay either within 21 or 30 days (select your best option).

A further 8% is charged on late loans as extension fee (one-time).

Beyond that, there are no further applicable fees when borrowing from Tala.

Moving on, Tala rewards you if you continuously make timely repayments by raising your loan limit and lowering the imposed service fee.

At the moment, the maximum loan you can access from Tala is shs.30000 repayable and you can only be permitted such an amount after borrowing and repaying several times.

How to reset Tala pin

Again resetting your Tala pin is quite straightforward.

Step-by-step:

- Open your App.

- Skip the Enter your Tala PIN and instead click on Forgot PIN?

- You’re prompted to type your National ID Card number. Do that.

- A new SMS with a Verification Code will be sent to you. Type this verification code in the indicated space the click Next.

- Now type your brand new Tala PIN.

What happens if you don’t pay your Tala loan?

Now, you don’t want to run away with Tala’s loan since the consequences can be drastic.

First, Tala will impose an 8% penalty on your outstanding loan so you will be forced to pay more.

Secondly, and more scaring, all Tala loan defaulters are submitted to CRB meaning that your chances of securing loans in Kenya will be severely hampered.

Still, Tala’s debt collection arm will be an unwelcome nuisance in your life with daily calls, threatening text messages, and such inconveniences.

Needless to say, you shall, in addition, be permanently blacklisted from this loan app.

You should also avoid delayed payments since they make your loan costly not to mention that it might cause your loan limit to be reduced further.

In fact, the surest way to secure larger Tala loans with time is repeatedly making on time payments.

· ALSO READ: How To Check CRB Status On Phone

Tala loan application form: Frequently asked questions (FAQs)

Now that we are discussing Tala, It’s only fair that we wind up our Tala loan application form article by answering some of the questions Kenyans ask about the app.

Here they are:

Q: How do I get a loan from Tala

I answered this already and we saw that you simply Download the Tala app, register (create an account), and finally, complete the Tala loan application form.

Q: How long does Tala take to approve a loan?

Minutes! You can have your loan in less than 3 minutes if you have entered everything correctly and has met all the requirements.

Q: How to answer Tala loan questions

As I had hinted, the questions are meant to help Tala gather some essential background information on its borrowers so it’s paramount that you give accurate answers.

Remember that loan apps rely on data from your phone when weighing loan applications and honest answers are key in the whole arrangement.

Q: What is Tala?

Tala is a mobile phone loan app run by an American Fintech. Their main business is to advance micro loans via the mobile phone and they have so far established operations in over 5 countries.

These include Kenya, neighboring Tanzania, Philippines, India, and Uganda.

Tala gets its funding from international lenders and has been growing exponentially since it first opened its doors in Kenya, a few years ago.

As a matter of fact, Tala has issued over an estimated shs.30 billion in loans to its customers and has been downloaded over 5,000,000 times.

Final thoughts

Any of us can run into a financial emergency at short notice.

A loved can fall ill suddenly, you can run out of cooking gas at night, or you might even require cash to take advantage of a sudden business opportunity.

Your kid could also be sent home because of school fees..

Now, if this happens, don’t panic for we have Tala..

Simply download the app and complete your Tala loan application form online.

And so long as your credit history looks fine, you will soon be sorted.

I have shown you every step so it should be easy for you.

Good luck and remember to pay back your Tala loan.

MORE RECOMMENDED ARTICLES:

· Kenya loans online: The 50+ best loan apps to borrow from

· CBA Loop app: What is, how to join, and get a loan

· Mshwari Lock Savings Account: All you need to know

I need loan from talla amount 15000

am in need of 10000 tala loan,my registered number is0703771817

Contact the Tala team from the app.

i need a loan of 20,000 how can i get?

Download the app and apply

Can i get a tala loan of 8000.

Please download the app and apply. It will give you feedback

thank you for starting this loan app

help me with 10000 laon

Download the app and apply. You’ll be assisted if you qualify

Im a new member please i need a loan

hey tala.. I paid my loan fully on 31st march..i immediately applied and still pending.. and am totally in need please. please help..

Contact TALA directly

i can get loan of 50000

Business